Mortgage Brokers Palm Beach

We make Palm Beach home loans easy

Our local mortgage brokers are here to help you with your home loan, construction loan, your first home loan or refinancing.

Connect With Our Local Brokers

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message. Please try again later.

Need home loan help? Contact our team, it's completely free.

Led by much loved local broker, Damian Wallace, we will help you find some of the industry's best rates and navigate the entire application process - to make everything easy and stress-free. We make buying a Palm Beach

home or investment property easy, so please don't hesitate to get in touch.

We've helped thousands of locals get better home loans.

Meet a few delighted Northern Beaches clients below.

How can our mortgage brokers Palm Beach team help?

1st or 5th Home Loan

Our Mortgage Brokers Palm Beach make the entire process hassle-free for home buyers, first or fifth home.

Investment Loans

Looking into an investment property? Our Mortgage Brokers Palm Beach can help secure your next investment.

Home Loan Refinancing

Need better rates or have a change in circumstances? Our Home Loan Advisors Palm Beach are the experts.

Commercial Loans

Commercial loans come with lots of fine details. Our Palm Beach team help remove the big, and small unknowns.

Instead of one lender, we compare 60+ leading lenders for you

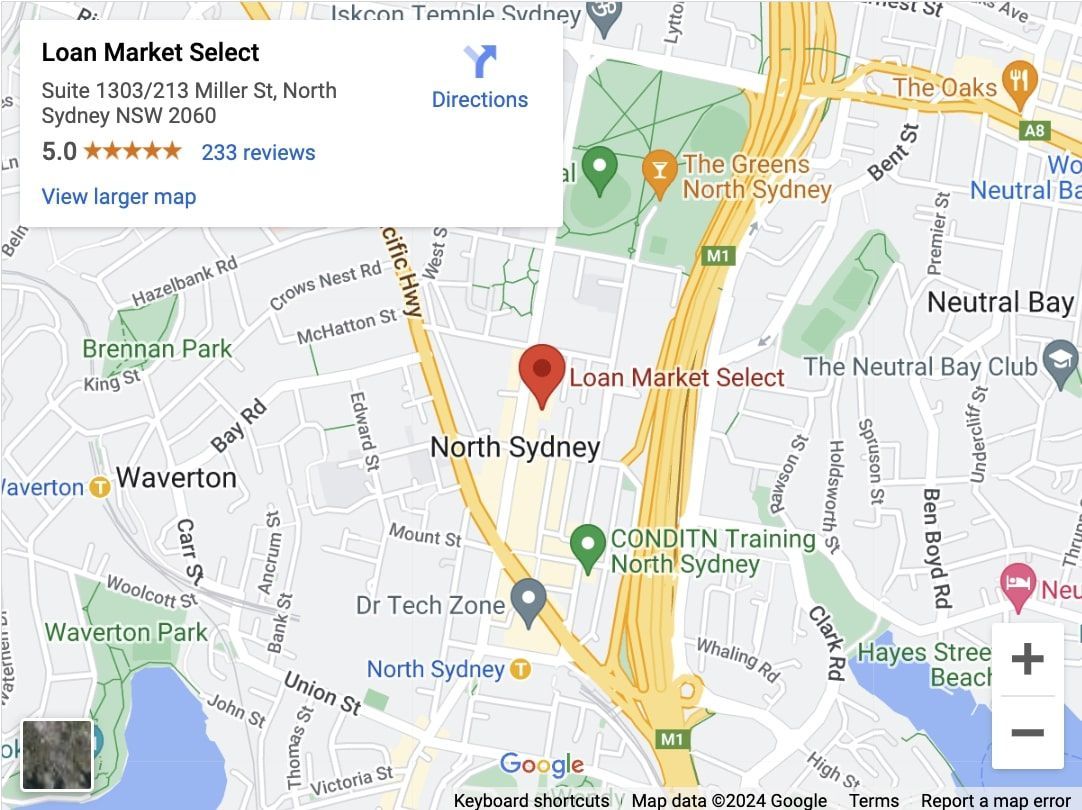

Prefer to visit our offices? Simply schedule a time

Dropping in for a cup of coffee can always help to get to know our local mortgage brokers a little better, or we can meet at a coffee shop near you.

This is our office address:

1303/213 Miller St, North Sydney, NSW, 2060

Let's make a time 📞 0403 316 686

Who do our local Mortgage Brokers Palm Beach help?

First Home Buyers Palm Beach

Finding the perfect first home can be daunting, and that's before you walk into a single bank for pre-approval or start the home loan application process. That's why we think you’ll love our simple, expert advice and help. We make the entire home loan process hassle-free for first time property buyers, from pre-approval, paperwork help, stamp duty to guidance on insurances - we're here for you every step of the way. Just call us on 0403 316 686 if you are a first home buyer in Palm Beach.

Home Buyers Palm Beach

If you're looking to upgrade, downgrade or side-grade your Palm Beach Sydney home, and need financing or refinancing, our local team have helped others transition seamlessly with market-leading loan rates - all without having to deal with the major banks or others in the lending industry. If you know the lending process, we can simply be your negotiation team, or let our experienced team help you with an initial loan health check.

Palm Beach Investment Buyers

With every local property market, not all properties or blocks of vacant land are great investments, and often to get the best returns, you'll need to have the right mortgage consultants who know the local area. As local investors and independent home loan brokers, our mortgage agents can help you get financing for your first, or fifth investment Palm Beach 2108 Sydney property. Just get in touch with us today on 0403 316 686.

Palm Beach Home Refinancing

Have your circumstances, life or financial goals changed? Or perhaps you’re looking to start those long-awaited renovations? Lots of people refinance for different reasons to find the right home loan for their current needs. Let our Sydney loan specialists provide honest advice and help you get competitive rates. We can also point you to our brilliant free online home loan calculators so you can see what any extra payments look like.

Palm Beach Construction Financing

Even with the best plans and project managers, building a new home or starting a major construction project like a granny flat or larger shed, can present many unknown challenges. This is where working with the Best Mortgage Broker Palm Beach really counts, with our combined experience and simple loan process for domestic and commercial property. The team here can help you remove the financial unknowns and help you find the right construction finance solution.

Palm Beach Self-Employed People

People with self generated incomes, i.e. not PAYG, like self-employed individuals, Sydney business owners and freelancers, might need specialised assistance in finding the right home loan options for their income structure and lender criteria. This is where our highly experienced, licensed mortgage broker team can help, from home loans to commercial loans. The team here truly understand the challenges self-employed people face, so just get in touch with us today on 0403 316 686 if you are looking for trusted Mortgage Brokers in Palm Beach!

Palm Beach Commercial Loans and Car Loans

We also help Palm Beach clients who need commercial loans or car loans, commercial vehicles included! The team here have access to hundreds of home loan products, and can often find a lender who is perfect for you commercial or car loan needs. This is also where our team, with in-depth banking and experience in finance, really shine.

Just get in touch with us on 0403 316 686 if you are looking for the best Mortgage Brokers Palm Beach!

What do our expert Palm Beach Mortgage Brokers do?

Our team are experts at making home loans easy, as we do all the heavy lifting for you. That's why we have loads of amazing 5-star reviews from our Palm Beach clients. We can help you in several ways, from pre-approval to mortgage insurances and more, and we're happy to go the extra mile to get your mortgage approval.

1. Home Loan Financial Assessment

Using a local mortgage broker Palm Beach can be a invaluable resource when navigating the local property market. We start by assessing your financial situation, whether you're a first-time homebuyer or buying your fifth investment property, to determine the right loan and lender for your needs. This includes analysing your assets, income, expenses, credit history, and overall financial readiness using responsible lending questionnaires. At this stage, we can also provide unofficial financial advice and credit advice to get you on the right track.

2. The Mortgage Pre-Approval Process

Our Mortgage Agents can help you get pre-approved for your next home loan. We help during every step of the loan process, including making the fine print and more complex details easy to understand. We also work with over 60 lenders when obtaining a conditional approval for your desired loan amount, which can give you a clearer idea of their budget when house hunting in Palm Beach 2108 postcode.

3. Local Palm Beach Housing Market Knowledge

A local mortgage broker Palm Beach has a great understanding of the Palm Beach real estate market. We can provide insights into property values, trends, and the local neighbourhoods that could suit your needs (such as school, shops, transport, investment potential etc), helping you make more informed decisions when buying a home or investment property.

4. Trusted Home Loan Comparison Shopping

Comparing loans and finance options from multiple lenders is a major part of what we do for clients, and why we’ve over 200 five star Google reviews! We help you find competitive interest rates and favourable loan terms for your borrowing power - with a huge range of lending solutions, including if you are looking at commercial lending. Be sure to get in touch with us today on 0403 316 686 if you’ve any questions.

5. Paperwork and Application Help

Mortgage advisors like us are the experts at assisting with the preparation and submission of your mortgage application, and that's what makes our range of services so valuable. We can help you gather the necessary documents and ensure that the application is completed accurately and promptly. This helps you reduce the time and stress that it takes to finance your home, or renovation financing.

6. Simplifying The Home Loan Process

Buying a home involves complex paperwork and processes. By using a local Mortgage broker Palm Beach, we can simplify the process by guiding you through each step and answering any questions you may have. From pre-approval, finding the most competitive market rates, accessing your current lender, performing the best mortgage comparisons around, our award-winning mortgage services is why we have so many 5-star Google review.

7. Ongoing Mortgage Support

When you use a local mortgage broker Palm Beach, your relationship shouldn’t end after your mortgage is approved. With our Palm Beach mortgage broker team, our support continues well after your loan goes unconditional, and we offer support, answer questions, and help with any issues that arise during the settlement process or during loan repayments, such as regularly checking in or looking into refinancing to ensure you are getting the best home loans rates.

Just get in touch with us on 0403 316 686 if you are looking for Mortgage Brokers in Palm Beach!

Why is Sydney’s Palm Beach 2108 a great place to buy a home or investment property?

Sydney’s Palm Beach 2108 is a great place to buy a home or investment property for several reasons:

1. Iconic Beachfront Location

Palm Beach is renowned for its stunning beaches, including the famous Palm Beach itself. The area's pristine sands, clear waters, and scenic views make it one of the most desirable coastal locations in Sydney.

2. Prestigious and Exclusive

Palm Beach is known for its exclusivity and prestige. The suburb attracts high-profile residents and has a reputation for luxury, making properties here highly sought after.

3. Strong Investment Potential

Due to its desirability and limited supply of properties, Palm Beach has shown strong property market growth. The area's exclusivity and high demand contribute to potential capital appreciation.

4. Luxury Homes and Architecture

The suburb features a range of luxury homes and architecturally designed properties, often with spectacular views of the ocean, Pittwater, and the surrounding natural beauty. These high-end properties are attractive to both homebuyers and investors.

5. Recreational Activities

Palm Beach offers a wealth of recreational activities, including swimming, surfing, boating, and fishing. The nearby Pittwater area is perfect for sailing and other water sports, enhancing the outdoor lifestyle.

6. Natural Beauty and Scenic Views

The suburb is surrounded by natural beauty, with Barrenjoey Headland, Ku-ring-gai Chase National Park, and numerous walking trails providing residents with stunning scenery and opportunities for outdoor exploration.

7. Proximity to Cafes and Dining

Palm Beach has a selection of high-quality cafes and restaurants, offering a variety of dining options. The area's culinary scene is complemented by its relaxed, beachside ambiance.

8. Cultural and Social Events

The suburb hosts various cultural and social events, including markets, art shows, and community gatherings. These events foster a sense of community and provide entertainment for residents.

9. Privacy and Seclusion

Palm Beach offers a high level of privacy and seclusion, making it an ideal location for those seeking a peaceful retreat from the city. This attribute is particularly appealing to celebrities and high-net-worth individuals.

10. High Rental Demand for Holiday Homes

Palm Beach is a popular destination for holidaymakers, leading to high rental demand for short-term holiday homes. This provides property investors with lucrative rental income opportunities, especially during peak tourist seasons.

11. Access to Quality Services

While Palm Beach offers a secluded and tranquil environment, it is still within reach of quality services, including healthcare facilities, shopping centres, and educational institutions in nearby suburbs.

12. Transportation Links

Although Palm Beach is relatively secluded, it has good transportation links, including ferry services to other parts of Sydney and bus routes connecting to major hubs. This makes it accessible while maintaining its exclusive feel.

13. Historical and Cultural Significance

Palm Beach has a rich history and cultural significance, with landmarks such as the Barrenjoey Lighthouse and heritage-listed properties adding to its charm and appeal.

14. Community and Safety

The suburb is known for its tight-knit community and low crime rate, making it a safe and welcoming place to live. The friendly community atmosphere enhances the quality of life for residents.

15. Environmental Sustainability

Palm Beach is committed to preserving its natural environment, with initiatives to protect its beaches, dunes, and native flora and fauna. This commitment to sustainability adds to the suburb's appeal.

In summary, Palm Beach 2108 offers a unique combination of luxury, natural beauty, recreational opportunities, and strong investment potential, making it an attractive suburb for both homebuyers and property investors.

Just get in touch with us on 0403 316 686 if you are looking for Mortgage Brokers in Palm Beach!

Who are the major home loan lenders in the Palm Beach 2108 area?

When it comes to securing a home loan, there are several major lenders including the big 4 Australian banks and financial institutions who operate across Palm Beach, and indeed the entire Sydney area. The problem is, there are an overwhelming amount of financial products that aren't always easy to understand - and every lender offers a wide range of loan products that are based on your borrowing capacity. So, how do you know which loan product to go with, and get the best customer service that is not “selling their own product”?

That where our team can help, we work with over 60 lenders helping first home owners to experienced investors with their property goals, through the whole process, from pre-approval, to even networking with local real estate agents to find the best best homes!

Here are some other lenders in Palm Beach you could consider:

1. Other Mortgage Brokers Palm Beach

Did you know that 70% of Australians now use a broker over a bank? A Mortgage Advisor is really the easiest way to go, no matter what home loan companies you're talking with. That’s because brokers work for you, not the banks - and we can help you quickly understand the types of loans available, and those that best suit your individual needs.

Other Mortgage Brokers in Palm Beach include Loan Market Palm Beach, Aussie Home Loans, Mortgage Choice Palm Beach, Lendi group and many more.

2. Major Banks

Australia's major banks like Commonwealth Bank, Westpac Bank, ANZ Bank, and National Australia Bank (NAB) offer a range of home loan products and personal loans. These banks have a significant presence in the local Palm Beach area and throughout Australia. The challenge with banks, is that they only offer their own. Home loan products, which means that to compare 60 lenders (like we do), you would have to visit 60 banks!! That’s why mortgage brokers are so sort after in Australia and write over 70% of residential home loans.

3. Non-Bank Lenders

Non-bank lenders without a physical office includes the likes of ING, ME Bank, Macquarie Bank and more, who might offer alternative home loan options and could be worth considering. Again though, like banks, they only offer their own home loan products, so you will be extremely limited and could take out a loan that is not ideal for your needs. You just need to do a lot of research when going directly with any kind of bank - and also be very careful of fees.

Just get in touch with us on 0403 316 686 if you are comparing lenders, we can help and our services are 100% free!

Need home loan help?

Simply contact our experts today, we can help.

CONTACT US

We're Mortgage Brokers Northern Beaches, your local brokers and part of the Loan Market Select team in North Sydney.

You can find our local office here:

1303/213 Miller St, North Sydney NSW 2060

FOLLOW US

HANDY LINKS

All Rights Reserved. SEO by Copyburst